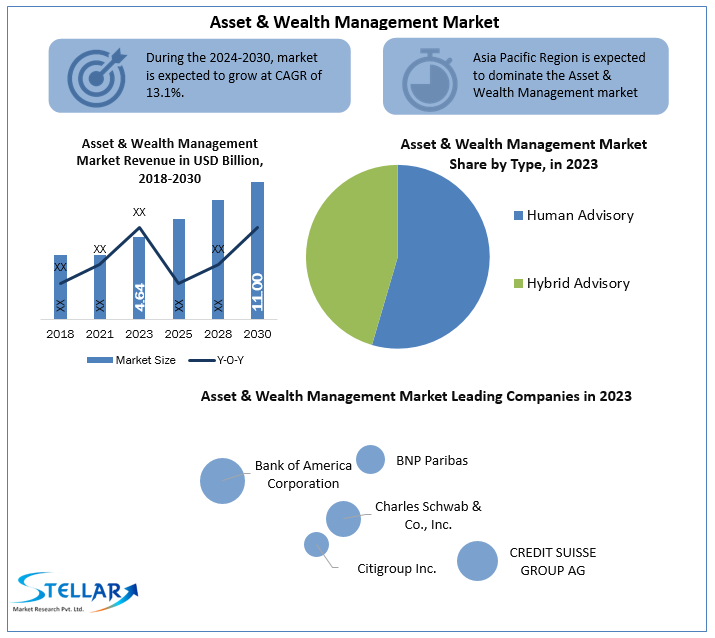

Asset & Wealth Management Industry size was valued at USD 4.64 Billion in 2023 and the total Market revenue is expected to grow at 13.1 % from 2024 to 2030, reaching nearly USD 11.00 Billion

Asset & Wealth Management Industry Report Overview

The current Asset & Wealth Management Industry landscape presents a dynamic and evolving scenario characterized by a mix of challenges and opportunities. Industries across the board are navigating through a complex web of economic, technological, and regulatory factors that shape their trajectories. The global economy continues to grapple with the aftermath of recent geopolitical events and the ongoing impacts of the COVID-19 pandemic, influencing consumer behaviors and Asset & Wealth Management Industry demands. Technology advancements, particularly in areas such as artificial intelligence, renewable energy, and digital transformation, are driving significant shifts in business strategies and operational models. Regulatory changes, environmental concerns, and shifting societal values are also shaping industries, fostering a greater emphasis on sustainability and corporate responsibility. Against this backdrop, companies are leveraging innovation and strategic partnerships to stay competitive and meet the evolving needs of their customer base. While uncertainties prevail, strategic agility and adaptability remain critical for organizations aiming to thrive in this dynamic industry environment.

Asset & Wealth Management Industry Report Scope and Research Methodology

The scope of this Asset & Wealth Management Industry report encompasses a comprehensive analysis of various sectors and industries, aiming to provide a holistic view of the current industry dynamics. The research methodology employed involves a meticulous approach, combining both quantitative and qualitative techniques. Extensive industry surveys, interviews with industry experts, and in-depth data analysis are integral components of the research process. The study includes an examination of industry trends, competitive landscapes, and emerging opportunities, allowing for a nuanced understanding of the factors influencing Asset & Wealth Management Industry growth. Additionally, a thorough review of relevant literature, company reports, and industry publications contributes to the robustness of the analysis.

The research methodology adheres to industry standards, ensuring the reliability and accuracy of the gathered information. This report aims to offer valuable insights and strategic recommendations, aiding businesses and stakeholders in making informed decisions within the dynamic industry environment.

Speak with our Research Analyst:https://www.stellarmr.com/report/toc/Asset-and-Wealth-Management-Market/1384

Asset & Wealth Management Industry Dynamics:

In the dynamic landscape of asset and wealth management, cutting-edge technologies are playing a pivotal role in reshaping the industry. Key technological components include artificial intelligence, machine learning, robotic process automation, Blockchain, Big Data, data management, distribution platforms, cryptography technology, crypto asset management, augmented and virtual reality, open application programming interfaces architectures, and wearable technology, among others. These technologies collectively contribute to providing users with a seamless and enhanced user experience while ensuring robust security measures against cyber threats. The integration of recent technological advancements into asset and wealth management software has significantly driven the adoption of such solutions. Companies across the sector are increasingly embracing these advanced technologies due to their transformative impact on the overall functionality of the systems, reflecting a broader trend of innovation within the Asset & Wealth Management Market.

Asset & Wealth Management Industry Regional Analysis

The regional analysis of the Asset & Wealth Management Industry provides a comprehensive overview of the geographical factors influencing industry dynamics. Examining various regions allows for a nuanced understanding of localized trends, economic conditions, and regulatory frameworks that impact industry behavior. By delving into specific geographical segments, this analysis aims to uncover regional variations in consumer preferences, purchasing power, and competitive landscapes. Factors such as cultural nuances, economic development, and infrastructure play a crucial role in shaping industry trends at the regional level. Understanding these dynamics enables businesses to tailor their strategies to meet the unique demands of each industry, fostering more effective industry penetration and expansion efforts. This regional analysis contributes valuable insights for businesses seeking to navigate the complexities of a diverse and multifaceted global industry landscape.

Asset & Wealth Management Industry Segmentation

By Business model

Human Advisory

Hybrid Advisory

By Provider

Traditional wealth manager

Bank

Asset & Wealth Management Industry Key Players

- Bank of America Corporation

- BNP Paribas

- Charles Schwab & Co., Inc.

- Citigroup Inc.

- CREDIT SUISSE GROUP AG

- Goldman Sachs

- JPMorgan Chase & Co.

- Julius Baer Group

- Morgan Stanley

- UBS

More Information About This Research Please Visit @https://www.stellarmr.com/report/Asset-and-Wealth-Management-Market/1384

Key Questions answered in the Asset & Wealth Management Industry Report are:

- What is Asset & Wealth Management?

- What was the Asset & Wealth Management Industry size in 2023?

- What will be the CAGR of the Asset & Wealth Management industry during the forecast period?

- Which region held the largest Asset & Wealth Management industry share in 2023?

- What are the opportunities for the Asset & Wealth Management Industry?

- What are the factors driving the Asset & Wealth Management industry growth?

- What factors are hampering the Asset & Wealth Management industry growth?

- Which company held the largest share in the Asset & Wealth Management industry?

- What key trends are likely to emerge in the Asset & Wealth Management industry in the coming years?

- What growth strategies are the players considering to increase their presence in Asset & Wealth Management Industry?

Key offerings:

- Past Industry Size and Competitive Landscape (2019 to 2022)

- Past Pricing and price curve by region (2019 to 2022)

- Industry Size, Share, Size & Forecast by different segment | 2024−2030

- Industry Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by region

- Industry Segmentation – A detailed analysis of segments and sub-segments

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Industry Leaders, Industry Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of business by region

- Lucrative business opportunities with SWOT analysis

- Recommendations

About Maximize Market Research:

Stellar Market Research is India Based consulting and advisory firm focused on helping clients to reach their business transformation objectives with advisory services and strategic business. The company’s vision is to be an integral part of the client’s business as a strategic knowledge partner. Stellar Industry Research provides end-to-end solutions that go beyond key research technologies to help executives in any organization achieve their mission-critical goals.

Contact Maximize Market Research:

S.no.8, h.no. 4-8 Pl.7/4,

Kothrud, Pinnac Memories

Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320 +91 9607365656